“Boston”

We were particularly pumped to meet with David Ellison, PM of the Hennessy Small Cap Financial Fund (HSFNX/$24.86) and the Hennessy Large Cap Financial Fund (HLFNX/$23.34), funds that I own personally. We first met Dave in the 1980s when he was managing the Fidelity Select Bank and Thrift Fund. From there, he went to Friedman, Billings & Ramsey (FBR) and managed two similar funds. Dave is arguably the smartest person we know on the financial complex. In fact, he actually went to 40% cash in early 2008, something most PMs won’t do. A number of years ago, FBR sold its asset management business to Neil Hennessy, captain of the Hennessy Funds, which is where Dave currently hangs his hat. Over the weekend, we read an article titled “Dividend Investors Take Note: Rising Rates Will Benefit Banks.” Plainly, we agree and recommend tilting accounts accordingly.

We also spent a lot of time with our friends at Putnam. First up was Darren Jaroch, PM of the Putnam Equity Income Fund (PEYAX/$24.89), also a fund that I own. We have met with Darren a number of times, and it is always informative. While many topics were covered, here are a few of his thoughts: he likes Japanese trading companies; copper has held its price near the highs despite the 10% pullback in the equity markets (strong economy); to be underweight Europe is dangerous, because Europe is no longer in recovery, rather, in economic expansion; the euro at $1.25 is not nearly as bad as two years ago; and unit labor costs in China are greater than the U.S. To that last point, we have argued there is a sea change occurring.

Foxconn, the world’s largest contract electronics manufacturer, and based in China, announced it was going to build a huge manufacturing plant in Wisconsin. That announcement begs the question WHY? Well, not only are wages going up in China, but the quality of manufactured products is going down. We think that suggests Mexico may be the new China for the U.S. Believe it or not, manufacturing standards in Mexico are up to U.S. standards. That point was reinforced by a senior executive at one of our large automobile companies who told me, “That’s right, the most productive and efficient plant we have is located in Mexico.” This is one of the reasons we have recommended various railroad stocks that play to this theme. Darren agrees and particularly likes the western and southwestern railroad companies.

Next, we met with Bill Kohli, PM of the Putnam Diversified Income Trust (PDINX/$7.07), yet another fund I own. Hereto, we have known Bill for a number of years and always enjoy meeting with him even though we are not really bond-centric investors. Bill’s fund seeks multiple sources of return outside the constraints of its benchmark, investing across traditional and alternative bond markets. Currently, the fund has a slight negative duration, because he thinks interest rates are normalizing and will trend higher at a gradual pace. He noted the default rate is only 1.1% and should go lower and that corporate balance sheets are really good. He also thinks we are working our way into tolerating higher interest rates. It’s the perfect environment.

The final meeting at Putnam was with Daniel Grana, PM of the Putnam Emerging Market Equity Fund (PEMMX/$13.23). This was my first meeting with Daniel, but it will not be my last. In fact, after chatting with him for over an hour, I went out and bought his fund. He asked me how I felt about emerging markets (EM), and I responded, “I like them if you have a three-year plus time horizon.” We chatted about the potential for a trade war with China. His thoughts are that the Chinese have a “scaled response” that would still be compliant with the World Trade Organization (WTO). For example, they could buy Airbus planes instead of Boeing planes. Also, the Chinese are primed and ready to target U.S. multinational companies. We then talked about Russia, since I think it is the cheapest stock market around. Daniel told us 2.5% of his fund is in Russian equities, because consumer spending is rising, Russia’s debt-to-GDP is under 20%, budget break-even cost for a barrel of crude oil is ~$40, and Russia trades at a 50% discount to the EM complex. We were very impressed with Daniel.

While we met with some other PMs in Boston, due to time and space constraints, we will have to expound on them at another time. Moving on to the equity markets, well so far the pattern Andrew and I laid out for the decline, and the subsequent bottoming sequence, has played almost on script. Last Friday, we said in our verbal strategy comment, as well on CNBC, that 2750 might be tough to surpass on this initial move. As can be seen in Chart 1 on page 3, the 20-day moving average (DMA) has been a really good predictor of the S&P 500’s (SPX/2732.22) direction for quite some time. When the SPX fell through the 20-DMA at ~2800, the result was a pullback to 2533 where a selling climax occurred followed by the prescribed failed throwback rally and the undercut “selling climax” of February 9. We termed the undercut low to be a BUY. However, the SPX has now rallied back into overhead resistance, and the 20-DMA is at 2750.65. But on Thursday night, the 20-DMA was at 2754, which is pretty much where Friday’s follow through rally was capped. Maybe the reason for that “capping” was the Russian indictments and worries they would spread to some U.S. counterparts. But, the fact of the matter is, the 20-DMA has become an important moving average.

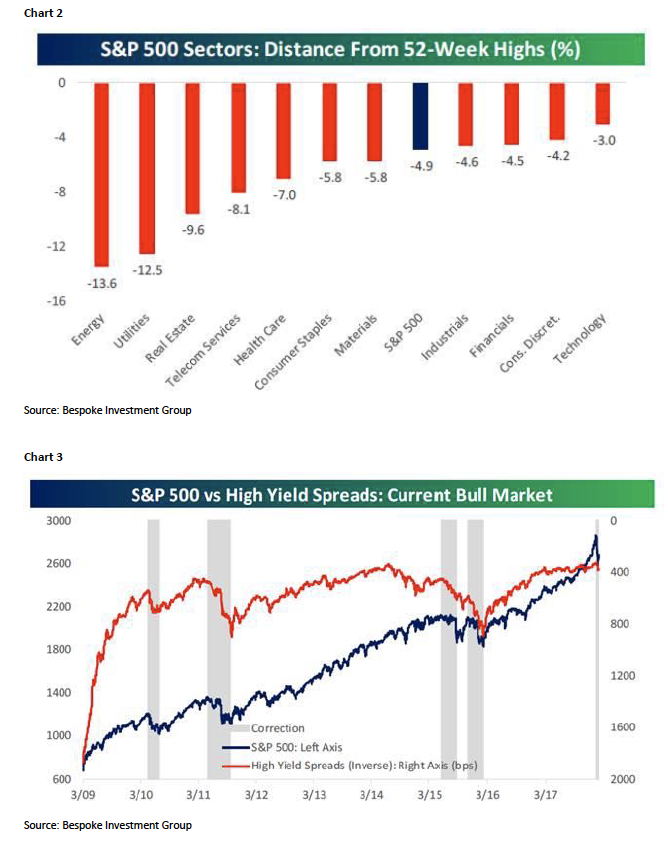

Speaking to EM, since the February 8 low, the sector-specific ETFs that have rallied the most are Emerging Markets and Technology with a gain of over 8%, yet the Financials sector ETFs have also done pretty well with a gain of over 6%. The quid pro quo is that the Energy has been slammed, leaving it off some 13% from its 12-month trailing high (Chart 2 on page 4). We like the energy space and use this weakness to accumulate Strong Buy names from the Raymond James research universe.

The tech ramp has left that space overbought on a short-term basis. What is interesting is that, in most 10% equity declines, there is a concurrent “hit” in the high yield complex (Chart 3 on page 4), but that just has not happened, which is amazing given the massive out flow of funds from HY bond funds.

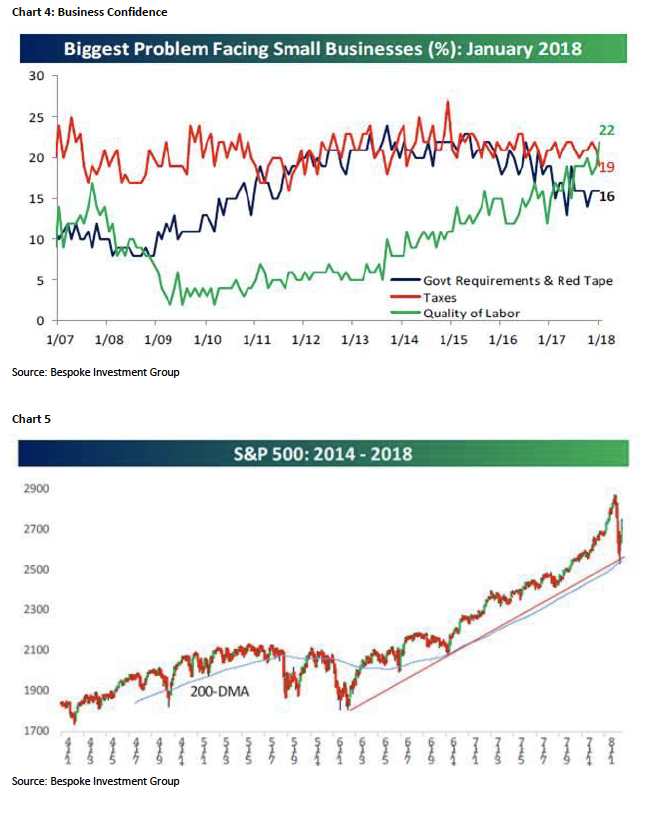

Turning to earnings, given our theme of two years that we have transitioned from an interest rate-driven to an earnings- driven secular bull market, earnings remain excellent. Of all the companies that have reported 4Q17 numbers, ~70% of them have beaten earnings estimates and 72.7% have bettered revenue estimates. In the S&P 500, the numbers are even better with nearly 80% and 77% beating earnings and revenue estimates, respectively. Further, more and more companies are raising forward earnings guidance. Manifestly, we have transitioned to an earnings-driven secular bull market. Of course, this is being reflected in business confidence where the biggest problem facing small businesses has shifted from government regulations and taxes to finding quality labor (Chart 4 on page 5).

The call for this week: We find it very interesting that the decline, and subsequent bottoming sequence, laid out in these reports has played so well. Moreover, the anticipated “selling climax” was foretold by two 90% Downside Days (90% of the total points, and total volume traded, came in on the downside). Then the rebound was accompanied by two 80% Upside Days. We also find it interesting that the decline stopped on the long-term uptrend line and the 200-DMA (Chart 5 on page 5). Ladies and gentlemen, all of this is suggestive that, barring a news surprise, a meaningful low has been seen. That said, the stock market’s internal energy is totally used up on a trading basis, and the 20-DMA capped this first upward thrust and should prove a stumbling block near term. Indeed, the SPX is now trapped between its 50-DMA (~2725) and the 20-DMA (~2751), as the 20-DMA we spoke of on Friday did stop the upside momentum. Usually such a moving average squeeze generates a decent move when a breakout occurs. We think the anticipated pause, or attempt to sell stocks off at the 20- DMA, will resolve itself to the upside. This morning, however, stocks are weaker across the board given the political news.