Investment Strategy: “Charts of the Week”

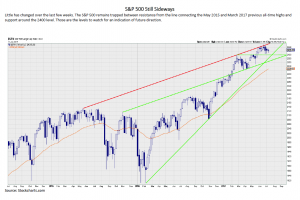

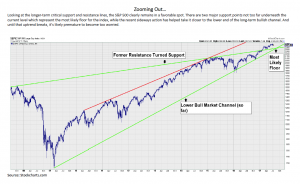

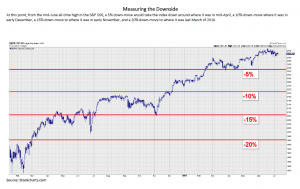

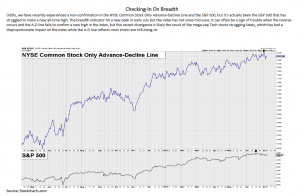

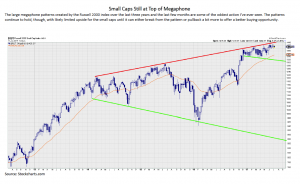

If the market is to drop significantly from here, it’s not going to be because everyone suddenly figured out the market cap-to-GDP ratio was extended or that valuations were stretched beyond a certain arbitrary threshold. It will more likely be caused by the economy starting to slump and earnings resuming the declines we saw from 2014-2016. And because the stock market has historically proven to be a fairly good leading indicator for both the economy and earnings, our primary focus is on stocks themselves instead of the multitude of data points that tend to get singled out one-by-one. It’s not that these data points don’t matter or that they’re not worth keeping in mind (we definitely do monitor and analyze them), but, as we continue to state, until the market starts to crumble under the weight of these negative items we don’t believe mo st long-term investors should take drastic action and unload their stocks. Keep in mind, the S&P 500 topped out in October 2007 but the real damage of that bear market was done much later. Moreover, there had already been clear deterioration under the surface of the market well before that October 2007 peak, with the percentage of stocks in the S&P 500 above their 200-day moving average topping out in February 2007 at 91% before crumbling to under 50% by October. Our main goal, therefore, is less about trying to cherry pick an absolute top of a multi-year secular bull market in advance of it happening, and more about spotting when things look to be getting better and when they look to be getting worse. The good news is that perfect precision and prognostication isn’t required for long -term success in the market, which is fortunate since I don’t know how to chart blind luck.

NOTE: Next week I will be attending the Raymond James & Associates Summer Development Conference in Washington D.C. I mention this because it means the Charts of the Week may be a little light next Wednesday due to traveling/presenting, but I also want to invite anyone that will be there to my session. I can only assume Raymond James wanted to kick off the conference with a bang because my presentation is in the very first time slot from 3:00 PM – 3:50 PM on Tuesday, July 18. So, if you’re not going for a fashionably late arrival, please stop by as I discuss the key investment themes we believe will drive the market over the next few years, specific investments that play to those themes, as well as detailing how we go about trying to find the high-growth areas that often become the “next big thing.”

Important Investor Disclosures

Raymond James & Associates (RJA) is a FINRA member firm and is responsible for the preparation and distribution of research created inthe United States. Raymond James & Associates is located at The Raymond James Financial Center, 880 Carillon Parkway, St. Petersburg, FL 33716, (727) 567-1000. Non-U.S. affiliates, which are not FINRA member firms, include the following entities that are responsible for the creation and distribution of research in their respective areas: in Canada, Raymond James Ltd. (RJL), Suite 2100, 925 West Georgia Street, Vancouver, BC V6C 3L2, (604) 659-8200; in Europe, Raymond James Euro Equities SAS (also trading as Raymond James International), 40, rue La Boetie, 75008, Paris, France, +33 1 45 64 0500, and Raymond James Financial International Ltd., Broadwalk House, 5 Appold Street, London, England EC2A 2AG, +44 203 798 5600. This document is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The securities discussed in this document may not be eligible for sale in some jurisdictions. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Investors should consider this report as only a single factor in making their investment decision. For clients in the United States: Any foreign securities discussed in this report are generally not eligible for sale in the U.S. unless they are listed on a U.S. exchange. This report is being provided to you for informational purposes only and does not represent a solicitation for the purchase or sale of a security in any state where such a solicitation would be illegal. Investing in securities of issuers organized outside of the U.S., including ADRs, may entail certain risks. The securities of non-U.S. issuers may not be registered with, nor be subject to the reporting requirements of, the U.S. Securities and Exchange Commission. There may be limited information available on such securities. Investors who have received this report may be prohibited in certain states or other jurisdictions from purchasing the securities mentioned in this report. Please ask your Financial Advisor for additional details and to determine if a particular security is eligible for purchase in your state. The information provided is as of the date above and subject to change, and it should not be deemed a recommendation to buy or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. Persons within the Raymond James family of companies may have information that is not available to the contributors of the information contained in this publication. Raymond James, including affiliates and employees, may execute transactions in the securities listed in this publication that may not be consistent with the ratings appearing in this publication. Raymond James (“RJ”) research reports are disseminated and available to RJ’s retail and institutional clients simultaneously via electronic publication to RJ’s internal proprietary websites (RJ Investor Access & RJ Capital Markets). Not all research reports are directly distributed to clients or third-party aggregators. Certain research reports may only be disseminated on RJ’s internal proprietary websites; however such research reports will not contain estimates or changes to earnings forecasts, target price, valuation, or investment or suitability rating. Individual Research Analysts may also opt to circulate published research to one or more clients electronically. This electronic communication distribution is discretionary and is done only after the research has been publically disseminated via RJ’s internal proprietary websites. The level and types of communications provided by Research Analysts to clients may vary depending on various factors including, but not limited to, the client’s individual preference as to the frequency and manner of receiving communications from Research Analysts. For research reports, models, or other data available on a particular security, please contact your RJ Sales Representative or visit RJ Investor Access or RJ Capital Markets. Additional information is available on request. Analyst Information

Analyst Information

Registration of Non-U.S. Analysts: The analysts listed on the front of this report who are not employees of Raymond James & Associates, Inc., are not registered/qualified as research analysts under FINRA rules, are not associated persons of Raymond James & Associates, Inc., and are not subject to FINRA Rule 2241 restrictions on communications with covered companies, public companies, and trading securities held by a research analyst account.

Analyst Holdings and Compensation: Equity analysts and their staffs at Raymond James are compensated based on a salary and bonus system. Several factors enter into the bonus determination including quality and performance of research product, the analyst’s success in rating stocks versus an industry index, and support effectiveness to trading and the retail and institutional sales forces. Other factors may include but are not limited to: overall ratings from internal (other than investment banking) or external parties and the general productivity and revenue generated in covered stocks.

The views expressed in this report accurately reflect the personal views of the analyst(s) covering the subject securities. No part of said person’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this research report. In addition, said analyst has not received compensation from any subject company in the last 12 months.