Investment Strategy: “The Ambergris Factor”

Ladies and gentlemen, investing is a lot like whaling. Investors are constantly searching for that whale of a stock with the “right stuff” . . . aka the “ambergris factor.” Indeed, there have been many such “whales” on the Street of Dreams since the Royal Bank of Scotland’s “sell everything” advice at the January/February of 2016 stock market lows. The problem with some of these “whales” is that they have become so large they are going to have a tough time continuing to grow at their previous rate; and, that’s the key, G-R-O-W-T-H. On Wall Street “growth” is the pleasing fragrance that brings in buyers and makes stocks go up and way up! Moreover, growth and growth rates is what legendary investor Peter Lynch looked for in selecting stocks. As he explained in his book One Up On Wall Street, it’s all based on the arithmetic of compound earnings. To wit:

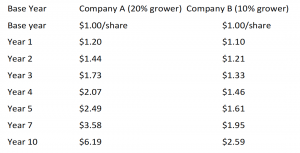

All else being equal, a 20-percent grower selling at 20 times earnings (a PE of 20) is a much better buy than a 10- percent grower selling at 10 times earnings (a PE of 10). This may sound like an esoteric point, but it’s important to understand what happens to the earnings of the faster growers that propels the stock price. Look at the widening gap in the earnings between a 20-percent grower and a 10-percent grower that both start off with the same $1 a share in earnings:

At the beginning of our exercise, Company A is selling for $20 a share (20 times earnings of $1), and by the end it sells for $123.80 (20 times earnings of $6.19). Company B starts out selling for $10 a share (10 times earnings of $1.00) and ends up selling for $26 (10 times earnings of $2.60). Even if Company A is reduced from 20 to 15 [times earnings] because investors don’t believe it can keep up its fast growth rate, the stock would still be selling for $92.85 at the end of the exercise. Either way, you’d rather own Company A than Company B. This in a nutshell is the key to big-baggers [the ambergris factor], and why stocks of 20-percent growers produce huge gains in the market, especially over a number of years.

Admittedly, it’s extremely difficult to find consistent 20-percent growers and to then have the courage to hold them for the long-term. But from a portfolio point of view, if you keep eliminating the stocks whose growth rate falters, you will avoid the “blubber” and be left with the “ambergris,” the chosen few which may turn into the 20-percent growers – the key to huge stock market gains.

I got a lot of emails on Friday asking why my models are counseling for a little caution here. Well, without telling folks how the proprietary models are actually constructed, suffice it to say they are not always right. However, they are right much of the time. So while I am not giving up the ambergris, I will share Friday’s missive from my friend Bob Pisani (as paraphrased):

August is typically a down month: the S&P has on average dropped 2.1% this month since 2010, according to Kensho, and right on schedule, the August slowdown has emerged. The issue is whether this will morph into something bigger. Consider:

The S&P 500, after an exceptionally strong July, has gotten stuck and is treading water for the past three weeks.

After a strong summer, the Russell 2000 has dropped below its 50-day moving average and is down six of the last eight trading sessions.

There has been a palpable slowdown in the pace of high-momentum technology shares. They are no longer on the new-high list. FANG stocks have lost momentum. Amazon is failing at its 50-day moving average. Google has broken its uptrend. Netflix gapped up on good earnings and guidance, but has been drifting lower since then.

Does the loss of momentum names necessarily mean the rally is over? No. Other sectors may rotate into leadership positions. There is some indication this is happening already. We have seen Financials make a modest move recently – the S&P Financial Sector hit a nine-year high today. And Industrial names – particularly defense and those with global exposure–remain strong.

So if we do get a pullback, what are some stocks with the “ambergris factor” that we should consider? As most of you know, we like triple-plays. That would be companies that in 2Q17 beat earnings and revenue estimates and guided future estimates higher. Five such names from the Raymond James research universe that have done so, are favorably rated by our fundamental analysts, screen positively on our proprietary models, and though they may not be 20% earnings growers, they do have a double-digit return on equity (ROE), according to Thomson Eikon. These stocks include: Apple (AAPL/$159.39/Outperform); LKQ (LKQ/$34.16/Outperform); OraSure Technologies (OSUR/$20.60/Outperform); Service Corporation (SCI/$34.81/Strong Buy); and Skyworks Solutions (SWKS/$102.55/Outperform).

The call for this week: The D-J Industrials have made new all-time closing highs for eight straight sessions and have made 34 all-time highs year-to-date. Still we keep hearing, as we have for years, “There is a stock market crash coming soon.” However, history shows stocks NEVER crash from new all-time highs without giving participants a chance to adjust portfolios. In 1929 the Dow made a new all-time high on 9/3/1929, but the crash came months later (October 28/29th). In 1987 the Dow made a new all-time high on 8/24/87, but the crash arrived on October 19, 1987. Moreover, as our friend Tony Dwyer (Canaccord Genuity) writes:

Think about all the non-recession 10%+ corrections over the past 25 years. Don’t they all start with an overbought condition, too much optimism, and a sense that a correction is overdue and should be bought? How then is one to determine if the correction would likely be temporary or something more significant? History serves as a great guide – even in the current cycle. Significant corrections, even if temporary, come with the perception of a probable recession. The two major corrections over the past 7 years (2011 & 2015-16) were associated with a global crisis that could have put the sluggish U.S. economy into recession. There is no sign of any significant deterioration in the (1) global synchronized recovery, (2) U.S. economic reacceleration, or (3) credit market environment that should create the fear of recession. As a result, we expect any correction to provide a better entry point for a move to our 2018 S&P 500 (SPX) target of 2,800 with a focus in the “pro-growth” sectors.

The S&P 500 Index has been trapped in the trading range of ~2470 – 2477 for 13 straight sessions. This lack of upward progress is dissipating the upside momentum and thus flashing warnings among technical momentum indicators. We continue to stand aside on a trading basis.

Important Investor Disclosures

Raymond James & Associates (RJA) is a FINRA member firm and is responsible for the preparation and distribution of research created in the United States. Raymond James & Associates is located at The Raymond James Financial Center, 880 Carillon Parkway, St. Petersburg, FL 33716, (727) 567-1000. Non-U.S. affiliates, which are not FINRA member firms, include the following entities that are responsible for the creation and distribution of research in their respective areas: in Canada, Raymond James Ltd. (RJL), Suite 2100, 925 West Georgia Street, Vancouver, BC V6C 3L2, (604) 659-8200; in Europe, Raymond James Euro Equities SAS (also trading as Raymond James International), 40, rue La Boetie, 75008, Paris, France, +33 1 45 64 0500, and Raymond James Financial International Ltd., Broadwalk

House, 5 Appold Street, London, England EC2A 2AG, +44 203 798 5600.

This document is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The securities discussed in this document may not be eligible for sale in some jurisdictions. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Investors should consider this report as only a single factor in making their investment decision.

For clients in the United States: Any foreign securities discussed in this report are generally not eligible for sale in the U.S. unless they are listed on a U.S. exchange. This report is being provided to you for informational purposes only and does not represent a solicitation for the purchase or sale of a security in any state where such a solicitation would be illegal. Investing in securities of issuers organized outside of the U.S., including ADRs, may entail certain risks. The securities of non-U.S. issuers may not be registered with, nor be subject to the reporting requirements of, the U.S. Securities and Exchange Commission. There may be limited information available on such securities. Investors who have received this report may be prohibited in certain states or other jurisdictions from purchasing the securities mentioned in this report.

Please ask your Financial Advisor for additional details and to determine if a particular security is eligible for purchase in your state.

The information provided is as of the date above and subject to change, and it should not be deemed a recommendation to buy or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. Persons within the Raymond James family of companies may have information that is not available to the contributors of the information contained in this publication. Raymond James, including affiliates and employees, may execute transactions in the securities listed in this publication that may not be consistent with the ratings appearing in this publication.

Raymond James (“RJ”) research reports are disseminated and available to RJ’s retail and institutional clients simultaneously via electronic publication to RJ’s internal proprietary websites (RJ Investor Access & RJ Capital Markets). Not all research reports are directly distributed to clients or third-party aggregators. Certain research reports may only be disseminated on RJ’s internal proprietary websites; however such research reports will not contain estimates or changes to earnings forecasts, target price, valuation, or investment or suitability rating. Individual Research Analysts may also opt to circulate published research to one or more clients electronically. This electronic communication distribution is discretionary and is done only after the research has been publically disseminated via RJ’s internal proprietary websites. The level and types of communications provided by Research Analysts to clients may vary depending on various factors including, but not limited to, the client’s individual preference as to the frequency and manner of receiving communications from Research Analysts. For research reports, models, or other data available on a particular security, please contact your RJ Sales Representative or visit RJ Investor Access or RJ Capital Markets.

Additional information is available on request.