Managing Risk

“Managing risk,” what a novel concept, but regrettably many investors fail to do just that. My father taught me to manage risk, a trait emphasized in the sentinel book by Benjamin Graham, The Intelligent Investor, which Warren Buffett has deemed, “The best book ever written on investing” and where the aforementioned quote resides. As my dad always reminded me, “If you manage the downside in a portfolio, and avoid the big loss, the upside will take care of itself.” However, managing risk is one of the hardest things to do, which is why you need a good financial advisor to help you manage the risk.

We are always attempting to manage risk and, most of the time, get it right. Sometimes, however, we too get blindsided. As Li Lu (a Chinese-born American investment banker, investor, and hedge fund manager) reminds us:

Investing is about predicting the future, and the future is inherently unpredictable. Therefore , the only way you can do better is to assess all the facts and truly know what you know and know what you don’t know. That’s your probability edge. Nothing is 100%, but if you always swing when you have an overwhelming better edge, then over time, you will do very well.

This is why, from time to time, we make “tactical calls” (short-term trading calls) when we do not feel all that comfortable with the near-term direction of the various markets. Most recently, that occurred at the beginning of August with the S&P 500 (SPX/2502.22) changing hands around 2490 as our short -term model registered a cautionary signal. At the time, we noted that and also suggested our internal energy model was out of energy, implying there should not be a whole lot of upside left for the equity markets. Sure enough, the SPX seems to have stalled with an intraday high “print” of some ~2508. Even our friend, and Canadian investing legend, Leon Tuey is looking for some kind of short-term pause within the construct of this secular bull market, for as he wrote last week:

Short-term, the major market indices and their internal measures are overbought. Moreover, short-term sentiment backdrop has deteriorated. Hence, a pause would not be surprising. After a minor pause, however, the rally will continue as the intermediate gauges are far from overbought. Moreover, momentum is re-accelerating. Long term, the primary trend remains powerfully bullish and the end is nowhere near in sight as the six major factors (monetary, economic, valuation, sentiment, supply/demand, and internal/momentum/technical) continue to give bullish readings. One of the most amazing aspects of this great bull market is sentiment. Although the bull market is in its ninth year and most stocks are up several hundred to several thousand percent, investors remain skeptical and pessimistic. Note that many hedge fund managers are bearish. Seth Klarman’s Blaupost holds 42% of its assets in cash. In terms of asset allocation, funds are sitting on a mountain of cash and very low in equities. In fact, funds are the most underweight in U.S. equities in ten years. Also worth noting is the shrinkage in the supply of stocks. In 1996, over 8000 stocks traded in the U.S. Today, that number has been halved. This supply/demand imbalance creates an explosive situation for the market. When the prevailing bearish sentiment recedes, that huge hoard of cash will find its way back to the equity market. I can hardly wait!

In conclusion, evidence continues to suggest that investors are witnessing the biggest bull market on record. The first leg of this great bull market commenced on October 10, 2008 and ended in May 2015. As always, it was driven by an easy/accommodative monetary policy. The second leg commenced in February 2016, which was driven by improving economic conditions caused by the monetary easing of the last 8.5 years. Hence, earnings momentum accelerates. Accordingly, it is always the longest and strongest [segment of a secular bull market]. Investors should emphasize industrials, technology, healthcare, and resource issues and other economy-sensitive areas.

One of the biggest mistakes investors make in a bull market is selling too soon. Accumulate favored areas when they are oversold and hold for the long-term. The time to liquidate is when the Fed starts to tighten meaningfully, i.e., when the Fed drains liquidity from the system; raises the discount rate many times in succession; and inverts the Classic Yield Curve (13-week T-bill Yield vs. the 20-year T-Bond Yield). Do not be distracted by the “noise” and the black headlines.

The call for this week: We find Leon’s cogent comments timely and are particularly interested in his emphasis on “resource

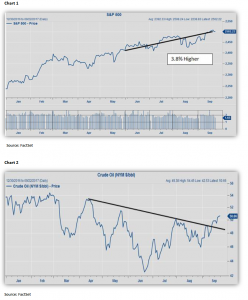

issues”, since we have been of the opinion that commodities have bottomed. Most recently, we discussed the Energy sector, because crude oil looks to have broken out to the upside in the charts (see Chart 1 on the following page) with particular interest in the midstream MLPs. Moreover, as we wrote last week:

In June, the three major indices traded out to new all-time highs, and we noted that, every time those indices simultaneously trade to new all-time highs, the SPX had an average 3.8% gain within the next three months nearly 100% of the time. Well, it is nearly three months later and the SPX is better by some 3.8%. Regrettably, we have underplayed that 3.8% rally, because our models went into cautionary mode at the beginning of August. Most recently, our stock market internal energy model telegraphed there just is not a whole lot of upside energy available right here. Then too, the momentum indicator theorizes the odds of a trend reversal are high on a short- term basis, the breadth indicator is neutral (no trend reversal), and the sentiment indicator is flashing extreme complacency (high degree for a trend reversal). To be sure, our indicators/models are not always right, but they are right a lot more than they are wrong. Sometimes they are early (September 1999 – bear signal, November 2002 – bull signal, November 2007 – bear signal, October 2008 – bull signal, well you get the idea). But just like when flying an airplane in a blackout, you have to trust your instruments. Our “instruments” continue to counsel for caution on a near-term trading basis, and we are titling portfolios accordingly. Longer-term, we remain in a secular bull market that has years left to run.

This morning, North Korea threatens strikes on U.S. mainland in response to DJT’s insults; the German election results were worse than expected; we expect a bunch of Fed officials to spout off this week with the Fed quiet period having ended last week; and with the NFL protests, we have now seen the politicization of everything! Nevertheless, the preopening S&P 500 futures are only down 4 points at 5:00 a.m.

Important Investor Disclosures

Raymond James & Associates (RJA) is a FINRA member firm and is responsible for the preparation and distribution of research created in the United States. Raymond James & Associates is located at The Raymond James Financial Center, 880 Carillon Parkway, St. Petersburg, FL 33716, (727) 567-1000. Non-U.S. affiliates, which are not FINRA member firms, include the following entities that are responsible for the creation and distribution of research in their respective areas: in Canada, Raymond James Ltd. (RJL), Suite 2100, 925 West Georgia Street, Vancouver, BC V6C 3L2, (604) 659-8200; in Europe, Raymond James Euro Equities SAS (also trading as Raymond James International), 40, rue La Boetie, 75008, Paris, France, +33 1 45 64 0500, and Raymond James Financial International Ltd., Broadwalk House, 5 Appold Street, London, England EC2A 2AG, +44 203 798 5600.

This document is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The securities discussed in this document may not be eligible for sale in some jurisdictions. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Investors should consider this report as only a single factor in making their investment decision.

For clients in the United States: Any foreign securities discussed in this report are generally not eligible for sale in the U.S. unless they are listed on a U.S. exchange. This report is being provided to you for informational purposes only and does not represent a solicitation for the purchase or sale of a security in any state where such a solicitation would be illegal. Investing in securities of issuers organized outside of the U.S., including ADRs, may entail certain risks. The securities of non-U.S. issuers may not be registered with, nor be subject to the reporting requirements of, the U.S. Securities and Exchange Commission. There may be limited information available on such securities. Investors who have received this report may be prohibited in certain states or other jurisdictions from purchasing the securities mentioned in this report.

Please ask your Financial Advisor for additional details and to determine if a particular security is eligible for purchase in your state.

The information provided is as of the date above and subject to change, and it should not be deemed a recommendation to buy or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. Persons within the Raymond James family of companies may have information that is not available to the contributors of the information contained in this publication. Raymond James, including affiliates and employees, may execute transactions in the securities listed in this publication that may not be consistent with the ratings appearing in this publication.

Raymond James (“RJ”) research reports are disseminated and available to RJ’s retail and institutional clients simultaneously via electronic publication to RJ’s internal proprietary websites (RJ Investor Access & RJ Capital Markets). Not all research reports are directly distributed to clients or third-party aggregators. Certain research reports may only be disseminated on RJ’s internal proprietary websites; however such research reports will not contain estimates or changes to earnings forecasts, target price, valuation, or investment or suitability rating. Individual Research Analysts may also opt to circulate published research to one or more clients electronically. This electronic communication distribution is discretionary and is done only after the research has been publically disseminated via RJ’s internal proprietary websites. The level and types of communications provided by Research Analysts to clients may vary depending on various factors including, but not limited to, the client’s individual preference as to the frequency and manner of receiving communications from Research Analysts. For research reports, models, or other data available on a particular security, please contact your RJ Sales Representative or visit RJ Investor Access or RJ Capital Markets.

Additional information is available on request.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds and exchange-traded funds carefully before investing. The prospectus contains this and other information about mutual funds and exchange –traded funds. The prospectus is available from your financial advisor and should be read carefully before investing.

Not approved for rollover solicitations.