Monty Hall and Door Number 1, 2, or 3

Three prisoners, A, B and C, are in separate cells and sentenced to death. The governor has selected one of them at random to be pardoned. The warden knows which one is pardoned but is not allowed to tell. Prisoner A begs the warden to let him know the identity of one of the others who is going to be executed. “If B is to be pardoned, give me C’s name. If C is to be pardoned, give me B’s name. And if I’m to be pardoned, flip a coin to decide whether to name B or C.” The warden tells A that B is to be executed. Prisoner A is pleased because he believes that his probability of surviving has gone up from one third to one half, as it is now between him and C. Prisoner A secretly tells C the news, who is also pleased, because he reasons that A still has a chance of one in three to be the pardoned one, but his chance has gone up to two in three. What is the correct answer?

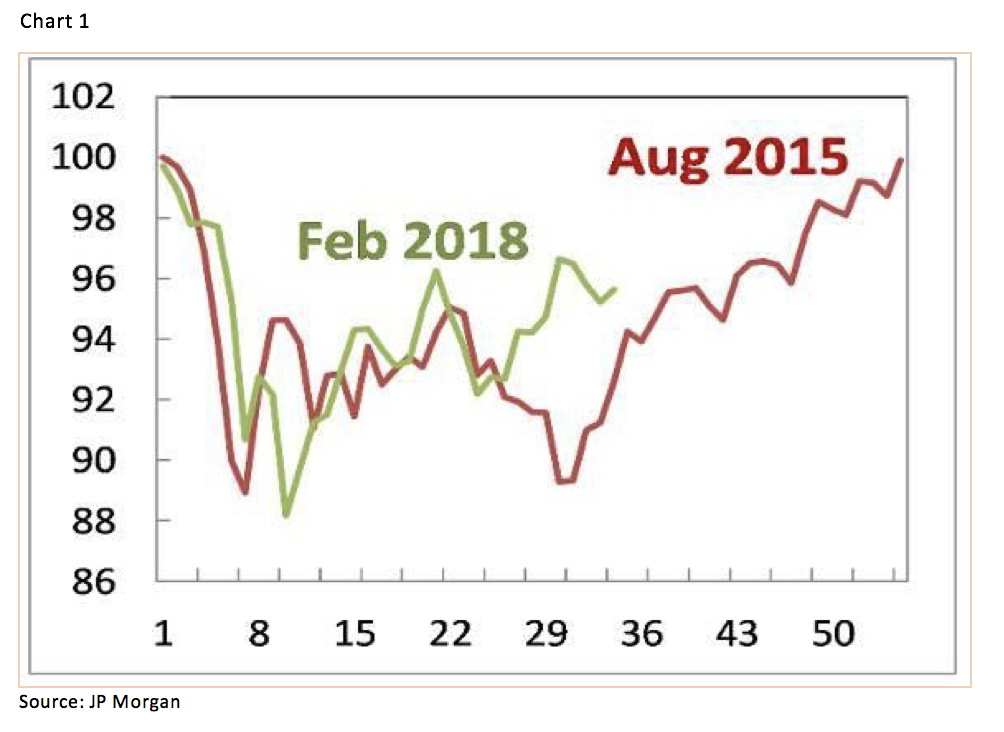

Similarly, like Monty Hall’s “Let’s Make a Deal,” investors have a choice between door number 1, 2, or 3. Door number 1 is that the equity markets are getting ready to trade out to new all-time highs. That view is shared by one of the best quantitative strategists on Wall Street, namely JP Morgan’s Marko Kolanovic whose recent report had this tag line, “Game theory implies low risk of trade wars; if equities follow 2015 flow patterns, new highs may come soon” (Chart 1 on page 2).

Door number 2 has it that the indices are likely to trade in consolidation mode over the next few months as they convalesce from last month’s heart attack that saw the S&P 500 (SPX/2752.01) surrender ~12% from intraday high to intraday low.

However, door number 3 tells a different story, as predicted by our friend Dennis Gartman, who wrote, “This then is our WATERSHED comment; it is time to hold cash; it is time to sell rallies; it is time not to buy weakness. As T.S. Elliot said, ‘Hurry up now, it’s time.’ We can trade other things bullishly, but equities we’ll not and as the markets rally this morning we shall watch from the sidelines.”

Now Dennis is a lot smarter than we are, but we do not embrace his bearish “call.” We do, however, agree with his, “We can trade other things bullishly.” One of the areas we think you should position your portfolio for is a more inflationary environment. As our pal Rich Bernstein, of Richard Bernstein Advisors (I own his funds), writes:

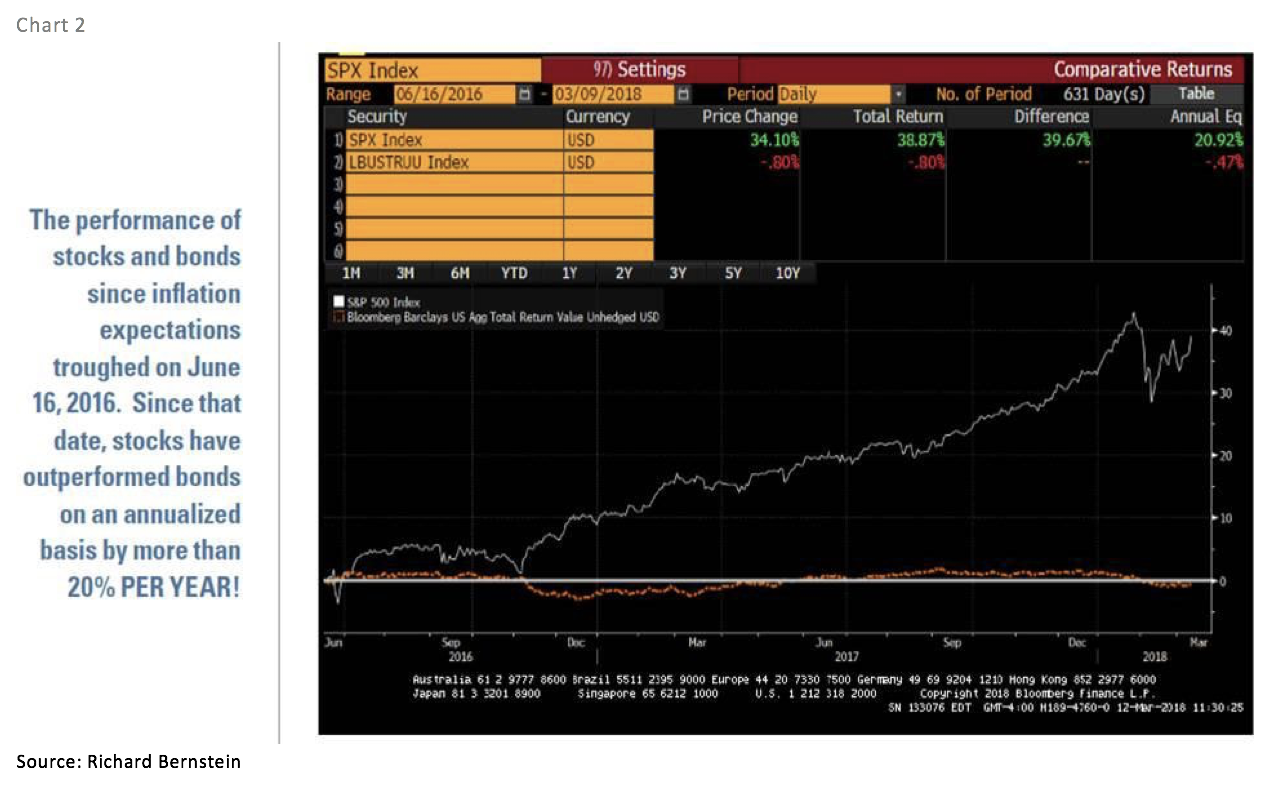

Inflation expectations troughed in June 2016 (!), and have been gradually rising since then. It seems immaterial from an investment point of view whether this increase in inflation expectations is secular or merely cyclical because investors are largely ill-positioned for any increase in inflation. Chart 2 [page 3] shows that the 10-year T-note yield troughed roughly 3 weeks after inflation expectations troughed. The sizeable flows into fixed-income investments ran unabated until only recently despite the increase in yields.

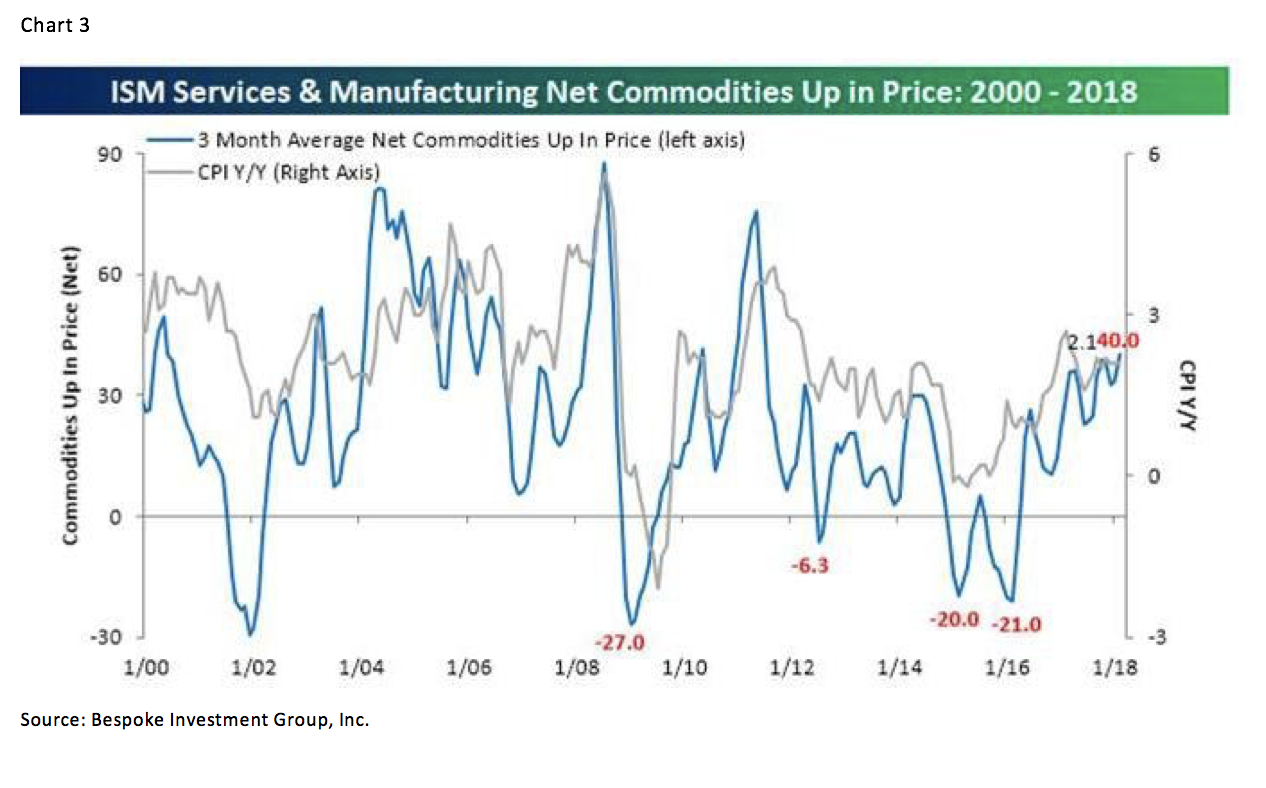

We agree with Rich that “Investors are largely ill-positioned for any increase in inflation” (Chart 3, page 3) and have recommended portfolios be tilted back towards “stuff stocks.” That’s a term we coined when China joined the World Trade Organization (WTO) in 2001 on the assumption per capita incomes in China were going to rise and that would drive increase purchases on “stuff” (metals, soybeans, fertilizers, cement, etc.).

As for the various “doors,” our sense remains that door number 1 is the correct scenario, since all of our models are currently aligned to the upside, the internal energy model has a full charge, and late last week the stock market took a decided step in that upside direction. Despite the late week rally, most of the indices closed down for the week. In fact, of all the indexes we monitor, only the D-J Utility Average was “up” on the week (+2.91%). We will note that the Advance-Decline Line remains strong (Chart 4, page 4), sentiment gauges remain bearish (read: that’s bullish), IPO volume (another gauge of sentiment) is muted, margin debt is nowhere near where peaks in the stock market occur, and the bullish list goes on. We will admit there have been some softer economic stats recently. Retail Sales, Philly Fed, NAHB Homebuilder Sentiment, Housing Starts, and Building Permits all came in below the estimates, causing the Atlanta Fed to lower this quarter’s GDP estimate to 1.9% from 2.5% (recall not too long ago the estimate was around 5%). The big economic event this week will be Wednesday’s Fed meeting where a 25 basis point rate hike is expected.

Speaking to the sectors, only the Real Estate (+1.28%) and Utility (+2.56%) sectors were better for the week. We, however, continue to favor the Technology, Financial, Industrial, and Energy sectors. Energy is particularly interesting since most of the energy stocks are trading at the same valuation levels they were when crude oil was trading at $26 per barrel, yet the April crude oil contract is currently changing hands around $62 per barrel. Within the energy space, the Master Limited Partnerships (MLPs) came under intense selling last week on this headline, “FERC Revises Policies, Will Disallow Income Tax Allowance Cost Recovery in MLP Pipeline Rates.” The selling, however, proved wrong-footed, because just about all the MLPs came out with statements that the ruling was non-impactful to their business models. Accordingly, we urge investors to consider the Strong Buy-rated MLP stocks from our Houston-based MLP fundamental analysts. Some of those Strong Buy rated names, which also screen well on our proprietary models, include: Enterprise Products (EPD/$25.40), Plains All American Pipeline (PAA/$21.96), Plains GP Holding (PAGP/$22.64), and Targa Resources (TRGP/$47.73).

Adding to our favorable stance on energy, and “stuff stocks” in general, is the sense the U.S. Dollar will remain under pressure. This also reinforces our views on increased inflation. While we do not think inflation will return to levels seen in the 1970s and 1980s, we do believe inflation will pick up in the months/years ahead and are positioning portfolios accordingly.

Again, as Rich Bernstein writes, “Investors are largely ill-positioned for any increase in inflation.”

The call for this week: Stocks struggled last week on tariff trauma, the White House shakeup, and the quiet period between earnings season. The Material and Industrial sectors were sold on fears that U.S. tariffs would drive up costs for manufactures. Bank stocks were also sold as interest rates declined and the yield curve flattened. As a result, the S&P 500 remained “pinned” around the 2750 level. The current question is will we retest the February 9 lows (SPX 2533) or trade out to new all-time highs. This morning, however, the typical post expiration pattern is playing where stocks tend to open soft and then rally on post-expiry position squaring. As we write at 6:01 a.m., the S&P futures are down 15.25 points on U.S. and Japanese political angst.

Important Investor Disclosures

Raymond James & Associates (RJA) is a FINRA member firm and is responsible for the preparation and distribution of research created in the United States. Raymond James & Associates is located at The Raymond James Financial Center, 880 Carillon Parkway, St. Petersburg, FL 33716, (727) 567-1000. Non-U.S. affiliates, which are not FINRA member firms, include the following entities that are responsible for the creation and distribution of research in their respective areas: in Canada, Raymond James Ltd. (RJL), Suite 2100, 925 West Georgia Street, Vancouver, BC V6C 3L2, (604) 659-8200; in Europe, Raymond James Euro Equities SAS (also trading as Raymond James International), 40, rue La Boetie, 75008, Paris, France, +33 1 45 64 0500, and Raymond James Financial International Ltd., Broadwalk House, 5 Appold Street, London, England EC2A 2AG, +44 203 798 5600.

This document is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The securities discussed in this document may not be eligible for sale in some jurisdictions. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Investors should consider this report as only a single factor in making their investment decision.

For clients in the United States: Any foreign securities discussed in this report are generally not eligible for sale in the U.S. unless they are listed on a U.S. exchange. This report is being provided to you for informational purposes only and does not represent a solicitation for the purchase or sale of a security in any state where such a solicitation would be illegal. Investing in securities of issuers organized outside of the U.S., including ADRs, may entail certain risks. The securities of non-U.S. issuers may not be registered with, nor be subject to the reporting requirements of, the U.S. Securities and Exchange Commission. There may be limited information available on such securities. Investors who have received this report may be prohibited in certain states or other jurisdictions from purchasing the securities mentioned in this report.

Please ask your Financial Advisor for additional details and to determine if a particular security is eligible for purchase in your state.

The information provided is as of the date above and subject to change, and it should not be deemed a recommendation to buy or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. Persons within the Raymond James family of companies may have information that is not available to the contributors of the information contained in this publication. Raymond James, including affiliates and employees, may execute transactions in the securities listed in this publication that may not be consistent with the ratings appearing in this publication.

Raymond James (“RJ”) research reports are disseminated and available to RJ’s retail and institutional clients simultaneously via electronic publication to RJ’s internal proprietary websites (RJ Investor Access & RJ Capital Markets). Not all research reports are directly distributed to clients or third-party aggregators. Certain research reports may only be disseminated on RJ’s internal proprietary websites; however such research reports will not contain estimates or changes to earnings forecasts, target price, valuation, or investment or suitability rating. Individual Research Analysts may also opt to circulate published research to one or more clients electronically. This electronic communication distribution is discretionary and is done only after the research has been publically disseminated via RJ’s internal proprietary websites. The level and types of communications provided by Research Analysts to clients may vary depending on various factors including, but not limited to, the client’s individual preference as to the frequency and manner of receiving communications from Research Analysts. For research reports, models, or other data available on a particular security, please contact your RJ Sales Representative or visit RJ Investor Access or RJ Capital Markets.

Links to third-party websites are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any third-party website or the collection or use of information regarding any website’s users and/or members.

Additional information is available on request.