“No Money, No Life!!”

Money is a vital life enhancer. If you have it, you can enjoy life incomparably more than if you don’t. The great storehouses of travel, leisure, rest, refinement, appearance, health, above all, peace of mind – all of these are open to you if you have money. It doesn’t have to be millions, or even hundreds of thousands. But it has to be enough so that you can know from one hour to the next that you are not going to be starved, dunned by your creditors, thrown out of your apartment, put on the street, made to fear becoming homeless . . . [that] has made me consider once again my aging parents and how very different their lives are. My parents, who are not really rich, have never, as adults, as far as I can recall, been seriously worried about money. There’s a simple reason for that: they have always lived modestly, even frugally, and have always had wants that are modest compared with their means. They are not geniuses at investing and have never been wildly well paid. They have just been like the ant, laying aside money year in and year out, and now they have a comfy cushion around them. They have never come even close to the edge of having to spend more than they have. Their friends and colleagues of their age all seem to be similarly situated. What I keep coming back to is that the real Bottom Line is a simple idea that the savers know and the terrorized don’t: Money is not for spending. Money is first for saving, and then spending.

Or, you might put it a different way. Money is not for spending now. Money is for spending on a rainy day. If that

rainy day doesn’t come in your life, it might come in your children’s or their children’s. Money is protection, the shield and the buckler for your family and for you. There is no new suit of clothes, no vacation, and no new car that can offset the pain of being truly worried about running out of money. I have had that fear. It comes at about five in the morning, and keeps you awake and makes your mouth dry and makes you hate the sound of the birds singing in the morning. It’s probably not realistic in my case, but I don’t want anyone I love to come even close to it . . .

The American Spectator, Benjamin J. Stein (March 1995)

We remember Ben Stein’s father Herb Stein. Herb Stein was chairman of President Nixon’s Council of Economic Advisors between 1972 and 1974. It was a depressing time with inflation rising and an attendant ascent in interest rates. Given his position, Dr. Stein was at the center of the economic maelstrom and consequently had to repeatedly respond to the inflation questions from a persistent press. After months of such questioning, a frustrated Herb Stein, when asked by a reporter to explain why inflation was getting so high, put on a straight face and said, “If you take out all the things in the Consumer Price Index that have gone up, the index would actually go down.” At another press conference, when he got irked with relentless questions on the same topic, Herb announced, “The Nixon Administration is against inflation, and it is against deflation, we are for ‘flation.”

Ben Stein’s parents sound a lot like our grandparents, and to some degree our parents. Our grandparents and their peers were just starting out in life during the Great Depression. After experiencing those horrible economic times, saving for a rainy day became second nature. The first worry was their job; then to put money away to buy a home and educate their children. Stocks never entered their mind after the 1929 crash and the subsequent Depression years. Financial survival for them and their own was the order of the day. They did without and swore it would never happen again. And most of all they wanted to make certain their children had a better life.

There has been nothing like the 1929 crash and those 1930s Depression years since; although for my generation the 1973 – 1974 Nifty-Fifty, One-Decision stock crash came close with stocks like Polaroid plunging from $140 to $14 along with all of the other One-Decision stocks. That debacle caused Richard Armour to write, “That money talks I’ll not deny. I heard it once it said good-bye!” Of course the 2007 – 2008 Dow Dive was no picnic either, but it didn’t cause the majority of stocks to lose 75%+ of their value. We found these thoughts appropriate over the weekend while contemplating the 30th anniversary of

the 1987 crash. We had been pretty cautious since September of that year given the Dow Theory “sell signal” and looked rather stupid as stocks traveled higher over the next four weeks until roughly the week before the crash.

Once again we have looked rather stupid over the past four weeks as the stock market has streaked higher. Yet as we have stated many times, “When the odds are tipped in our favor as an investor we tend to err on the side of caution.” That has been the case over the past number of weeks as stocks have “melted up.” To us the current environment, not that we are predicting a crash, reminds us of the letter Warren Buffett wrote in 1969 when he gave his investors their money back. To wit:

Essentially, I am out of step with present conditions. On one point, however, I am clear. I will not abandon a previous approach whose logic I understand (although I find it difficult to apply) even though it may mean foregoing large and apparently easy profits to embrace an approach which I don’t fully understand, I have not practiced successfully and which, possibly, could lead to substantial permanent loss of capital.

And, that’s how we feel currently. The models that have served us well over the decades are “currently out of step with

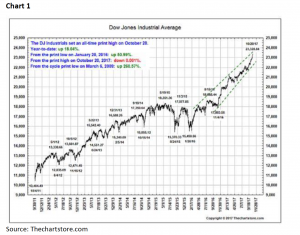

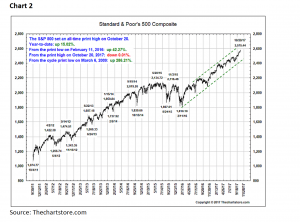

present conditions.” The reason why is demonstrated by the fact that if the S&P 500 (SPX/2575.21) makes it for another 21 sessions, without a 3% pullback, it will be the longest such streak on record! No wonder our models appeared flawed, but like Buffett, “I will not abandon a previous approach whose logic I understand.”

As our friend, and portfolio manager, Craig White of the firm HugganWhite reminded us over the weekend in Montreal when he wrote:

In response, our tactical call is to avoid chasing returns at this time. Putting new money to work at all-time highs may prove to be advantageous, but we feel the odds are not in one’s favour at these levels. As always, security selection is critical with correlations now at cyclical lows and dispersion across sectors widening. The proliferation of index based exchange traded funds (now ~35% of S&P 500) has pushed all constituents higher, regardless of Fundamentals.

Tactically, our advice is to sift through portfolios looking for names that have underperformed relative to their peers and who have not participated in this “push” to new highs. These positions may represent “broken stories” and likely have a higher degree of downside risk should weakness emerge in the near term. Sectors or names that have become overweight based on asset allocation targets could also be trimmed to raise cash. Recall though, maintaining exposure to “winners” is often a challenging feat (tendency to sell to early), so avoid a quick emotional “victory” trade. At this time it’s best to determine your targeted cash weighting and work hard to find those weak links. Longer term though, the bull market remains intact so use any envisioned weakness to redeploy cash, taking advantage of the tailwinds that have served equity investors so well over the course of this structural secular advance. Indeed, pick your spots baby . . . pick your spots!

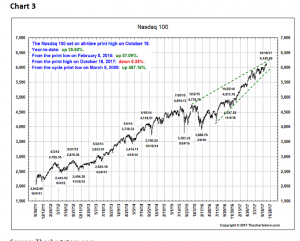

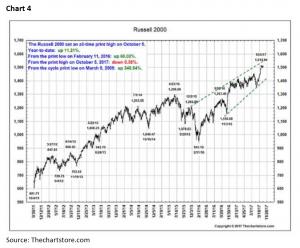

The call for this week: So last week the Senate passed a budget resolution that should lead to corporate tax cuts reducing the corporate tax rate from an average of 27% to 20%, which could add another $10.00 to S&P’s bottom up, operating earnings, estimate for 2018 of ~$144, implying it may rise to $155. If investors continue to pay 19x for forward earnings that implies a price target of 2945. We actually think that is reasonable despite our cautionary stance for the past few weeks. Another plus for the equity markets is that we hear, from our D.C.-based contacts, that President Trump is considering having both Taylor and Powell serve at the Federal Reserve (read: unique). We have repeatedly noted many of the indices have formed bearish upside “rising wedges” chart patterns (see charts) suggesting either stocks must explode higher, or a near-term top was at hand. Obviously, the upward explosion has occurred in this parabolic rally, which typically tends to end badly on a trading basis; NOT that we are suggesting this deters our ongoing secular bull market thesis, but just a cautionary note on a trading basis. This morning the world markets are higher on the Japan win, but our markets are flat.