Sittin’ on the Dock of the Bay

So I am sittin’ on a dock of the bay here in Boca Raton Florida watchin’ the tide roll away as I wait to speak at a conference of insurance CEOs and CFOs. I have spoken at this annual event for the past 10 years, and it is always a “gas” because the attendees are terrific people. I love Boca Raton, although the traffic is absurd as it took me two hours to drive to Fort Lauderdale yesterday to visit with friends at Franklin Templeton (I really miss Sir John), and Rajiv Jain, portfolio manager of the Goldman Sachs GQG Partners International Opportunities Fund (GSIMX/$12.81), which I own (Rajiv). I first met Rajiv about a year ago when he became an outside manager for Goldman Sachs after managing $40 billion for a bank in Geneva. I know a lot of portfolio managers, but this guy is arguably the smartest guy in the room. The day after I met him I bought GSIMX and I am very glad I did! Unsurprisingly, Rajiv and I are of the same belief in that we think the equity markets are into a secular bull market that has years left to run. Speaking to China, I have argued for the past eight years that China is NOT about to sink into the abyss and drag the entire world into a recession. Rajiv agrees and noted that the thing that shocked stocks in 2008 was the fact that housing prices collapsed and left the banks with worthless mortgages that threatened to implode the financial fabric of America. However, according to Rajiv that is not occurring in China; in fact, home prices are actually rising in China! Moreover, it is not just China whose economy is improving; a synchronized worldwide economic recovery is underway. No wonder the world’s bourses are rallying!

In addition to discussing the “state of the state,” we talk investing. When we first met, Rajiv suggested I look at certain large French banks that are conservatively run. His thought was that the then new President of France, Emmanuel Jean-Michel Frédéric Macron, was going to change the work habits of French workers (although everyone I know in France works harder than I do), which is why the French unions hate him. I learned from Peter Lynch, a long time ago when the Rust Belt was about to rebound (early 1980s), that while it may not be sexy to buy the banks when a region is going to recover, it tends to be a very profitable strategy. And while Raymond James does not cover the European banking sector, we commend this sort of investment approach when applied to our own coverage of regional banks. Of course, you can always get access to Rajiv’s ideas by just buying his fund; please check with our mutual fund research team for more insight.

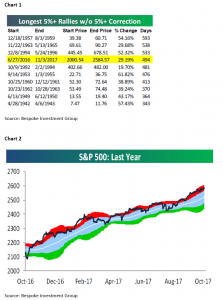

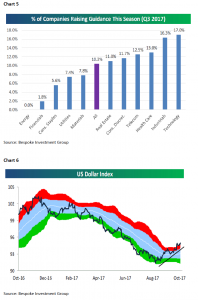

Of interest is that while the S&P 500 and D-J industrial Average closed up on the week, the mid-caps and small-caps actually lost ground last week with the S&P Small Cap 600 surrendering some 1.5%. Internationally, Brazil got whacked (-4.9%), while India, Japan, and Europe all gained. Speaking to the S&P 500 (SPX/2587.84), all that index needs is six more sessions to cross the 500-day mark without a 5% correction, as can be seen in chart 1 on page 3. Last week’s “win” was basically driven by just two sectors – Energy and Technology – while underlying market breadth actually deteriorated. The SPX rally also has left the index at the top of its trading band and consequently pretty overbought (chart 2). Of particular interest is that a favorite sector, namely Tech, is WAY overbought (chart 3 on page 4). I did get a rather intriguing question at the conference – “How is the SPX up without the FAANGs stocks?” Coincidentally, that question can be answered by studying chart 4. Meanwhile, the earnings-driven secular bull market is alive and well with 63.7% of companies reporting earnings beating estimates and 61% bettering revenue estimates. Importantly, companies are raising forward earnings guidance with the biggest raises coming in Technology (chart 5 on page 5).

Also worth noticing is that the U.S. Dollar Index has been rallying (chart 6), which puts the wind at the back of companies that generate a significant portion of their revenues here in the USA. The reason for the “buck’s” strength is obviously the hint of higher interest rates, where the odds of a December rate ratchet have leaped (chart 7 on page 6). Crude oil has also broken out to the upside in the charts, lending more credence to our now year-long “call” that most commodities have bottomed.

Indeed, looking at the Commodity Research Bureau’s index (CRB) of 18 commodities shows that on a trailing rolling 10-year return said index has a negative return, which has not happened since the 1930s. The CRB chart is reminiscent of the same chart we showed of the S&P 500 in late 2008 and early 2009, which was similarly configured with a negative 10-year trailing return that had not happened since the 1930s.

As for all the questions we get about Bitcoin, as often stated, I do not invest in things I do not understand, another trait I learned from Peter Lynch, and I do not understand Bitcoin (chart 8). So our cautious stance on stocks for the past six weeks has proven wrong, although we still have found some names to buy despite our near-term cautious stance. Of course such short-term “trading calls” are just that – trading calls – all within the context of a secular bull market that has YEARS left to run.

The call for this week: I went back and studied my notes dating back to the 1960s and after ALL the rallies like we have seen since the November presidential election (the runaway rally that we called), most of the gains have been given back in a

“selling stampede.” Not that we are predicting an end to the secular bull market, for we are not, but there is NO exception to the subsequent outcome. The only time stocks have not suffered such an outcome has been at the start of a huge up move. Obviously, we are not at the start of a huge up move. That said, pullbacks are for buying because we believe this secular bull market has at least another 10+ years left in it! This morning the preopening futures are flat at 5 a.m. on no real overnight news . .

Important Investor Disclosures

Raymond James & Associates (RJA) is a FINRA member firm and is responsible for the preparation and distribution of research created in the United States. Raymond James & Associates is located at The Raymond James Financial Center, 880 Carillon Parkway, St. Petersburg, FL 33716, (727) 567-1000. Non-U.S. affiliates, which are not FINRA member firms, include the following entities that are responsible for the creation and distribution of research in their respective areas: in Canada, Raymond James Ltd. (RJL), Suite 2100, 925 West Georgia Street, Vancouver, BC V6C 3L2, (604) 659-8200; in Europe, Raymond James Euro Equities SAS (also trading as Raymond James International), 40, rue La Boetie, 75008, Paris, France, +33 1 45 64 0500, and Raymond James Financial International Ltd., Broadwalk House, 5 Appold Street, London, England EC2A 2AG, +44 203 798 5600.

This document is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The securities discussed in this document may not be eligible for sale in some jurisdictions. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Investors should consider this report as only a single factor in making their investment decision.

For clients in the United States: Any foreign securities discussed in this report are generally not eligible for sale in the U.S. unless they are listed on a U.S. exchange. This report is being provided to you for informational purposes only and does not represent a solicitation for the purchase or sale of a security in any state where such a solicitation would be illegal. Investing in securities of issuers organized outside of the U.S., including ADRs, may entail certain risks. The securities of non-U.S. issuers may not be registered with, nor be subject to the reporting requirements of, the U.S. Securities and Exchange Commission. There may be limited information available on such securities. Investors who have received this report may be prohibited in certain states or other jurisdictions from purchasing the securities mentioned in this report.

Please ask your Financial Advisor for additional details and to determine if a particular security is eligible for purchase in your state.

The information provided is as of the date above and subject to change, and it should not be deemed a recommendation to buy or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. Persons within the Raymond James family of companies may have information that is not available to the contributors of the information contained in this publication. Raymond James, including affiliates and employees, may execute transactions in the securities listed in this publication that may not be consistent with the ratings appearing in this publication.

Raymond James (“RJ”) research reports are disseminated and available to RJ’s retail and institutional clients simultaneously via electronic publication to RJ’s internal proprietary websites (RJ Investor Access & RJ Capital Markets). Not all research reports are directly distributed to clients or third-party aggregators. Certain research reports may only be disseminated on RJ’s internal proprietary websites; however such research reports will not contain estimates or changes to earnings forecasts, target price, valuation, or investment or suitability rating. Individual Research Analysts may also opt to circulate published research to one or more clients electronically. This electronic communication distribution is discretionary and is done only after the research has been publically disseminated via RJ’s internal proprietary websites. The level and types of communications provided by Research Analysts to clients may vary depending on various factors including, but not limited to, the client’s individual preference as to the frequency and manner of receiving communications from Research Analysts. For research reports, models, or other data available on a particular security, please contact your RJ Sales Representative or visit RJ Investor Access or RJ Capital Markets.

Links to third-party websites are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any third-party website or the collection or use of information regarding any website’s users and/or members.

Additional information is available on request.