Street Smarts

Years ago we read a book that a Wall Street pro told us would give us good judgement by benefitting from the experiences of others who had suffered hard hits. The name of the book was “One Way Pockets.” It was first published in 1917. The author used the nom de plume of Don Guyon because he was associated with a brokerage firm having a sizeable business with the public and he had conducted an analytical study of orders executed for active public traders.

The results were “illuminating enough to afford corroborative evidence of general trading faults which persist to this day.” The study detected “bad” buying and “bad” selling, especially among active and speculative participants. It documented that the public “sells too soon, repurchases at higher prices, buys more after the market has turned down and finally liquidates on breaks… a true response in all similar Wall Street periods.”

For instance, the book showed that when a bull market begins the accounts under analysis would buy for value reasons; buy well, though very small. The stocks were originally bought for the longer term rather than for day-to-day trading purposes. But as prices moved higher participants were so scared by memories of the previous bear market, and so worried they would lose their profits, they sold. At this stage “the accounts showed scores of complete transactions, yielding profits of less than two points, liberally interspersed with losses.”

Then in the second phase, when accounts were convinced that the bull was for real and a higher market level was established, stocks were repurchased, usually at higher prices than where they had previously been sold. “At this stage larger profits were the rule; three, five, seven and even ten points were taken… the advance had become so extensive that several attempts were made to find the ‘top’ with short sales… the experiments were almost always disastrous.”

Finally, in the latter stage of the bull market the recently active and speculative accounts would tend not to over-trade or try to pick “tops,” but resolved to buy and hold. So many times previously they had “sold” only to see their stock dance higher, leaving them frustrated and angry. “The customer who months ago had been eager to take a profit on 100 shares of stock would not take ten points of profit on 1000 shares of the same stock now that it had doubled in price.” In fact, when the market finally broke down, even below where accounts bought their original stock, they bought more. They would not sell. The tendency of the trading element at this mature stage of the bull market was to buy breaks. The author concludes that their trading “methods had undergone a pronounced and obvious unintentional change with the progress of the bull market from one stage to another . . . a psychological phenomenon that causes the great majority to do the direct opposite of what they ought to do!” Conclusion: “The collective operations of the active speculative accounts must be wrong in principal… so the method that would prove profitable in the long run must be the reverse of that followed by the consistently unsuccessful.”

Not much has changed from 1917 to 2017, just the players, not the emotions of greed versus fear or supply versus demand. Like in the book “One Way Pockets,” we too have studied the psychological mindset changes participants go through over the course of a secular bull market. As Ray DeVoe notes, they are: 1) Aftershock and Rebuilding; 2) Guarded Optimism; 3) Enthusiasm; 4) Exuberance; 5) Unreality; and finally 6) Cold Water and Disillusionment. Clearly we are nowhere near “Enthusiasm, Exuberance, or Unreality.” We think investors’ mindset is currently at “Guarded Optimism.” And that “Guarded Optimism” continued last week as the D-J Industrial Average (INDU/20547.76) broke a two-week losing streak by gaining 0.5%. In last Monday’s report Andrew and I hinted that might just be the case when we wrote:

It should also be noted that our measurement of the stock market’s “internal energy” levels are almost back to a full charge, implying if the downside gets going there is enough energy for a decent move. If that is the case, the strongest “energy flows” should come early this week, suggesting the potential for a trading bottom late week. Also suggestive of a trading bottom are the Volatility Index (VIX/15.96), the CBOE Put/Call Ratio, and the sentiment readings.

Well, we didn’t get the perfect pattern last week, which would have been an early week whoosh to the downside into the long-targeted 2270 – 2280 level by the S&P 500 (SPX/2348.69). However, late last week we advised participants to get their “buy lists” ready because a rally may be in the cards. We still feel that way. Indeed, since being in cautionary mode from the first week in February our models took a decided turn for the better last week despite the backdrop of nasty geopolitical events, mixed economic reports, and some earnings misses. Our sense is that over the next few weeks the lack of “selling pressure” is going to allow stocks to attempt to lift. While we don’t think it will be a vigorous “lift,” it should still be a lift. Accordingly, we would urge you to sift through the stocks featured in these missives over the past few months that Andrew and I have suggested you put on your “watch lists” for potential purchase when the time was right. We think the time is finally right after the past nearly three months of “going nowhere” consolidation.

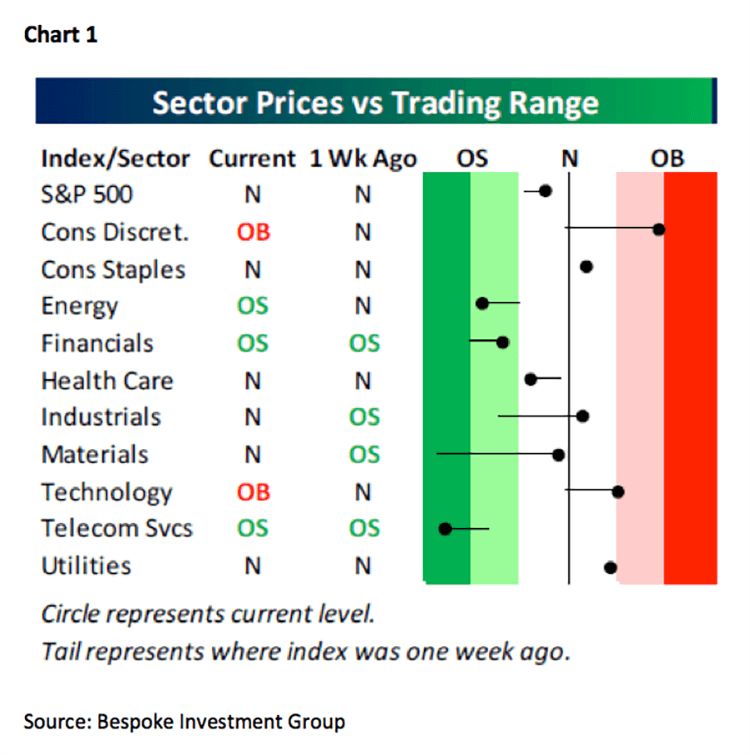

The call for this week: This week Andrew and I are in Orlando at the Raymond James National Conference where we will be seeing portfolio managers, financial advisors, and giving a keynote address. Hopefully the equity markets will give an “upside address” of their own in our absence. To that point, it is worth mentioning that there has been an “internal correction” going on for the past few months, leaving only 25% of the S&P 500 stocks above their respective 10-day moving averages (DMAs). Meanwhile, 75% of the S&P 500 stocks reside above their 200-DMAs, which is evidence that the primary trend of the equity market is still “up.” Plainly, Dow Theory agrees with that! Amazingly, the equity markets have held up pretty well despite the talk of thermonuclear war and ICBMs, implying this has been a three-month bullish upside consolidation pattern. That is very much like the 18-month bullish consolidation chart pattern that occurred between November 2014 and July 2016, where the Bear Boos told us it was a major top, yet we remained steadfastly bullish. Ladies and gents, this is a secular bull market with years left to run. In addition to the stocks featured in our reports, the only sector that is “overbought” in the short-term is Consumer Discretionary (see chart 1 on page 3). And over the weekend Macron (the globalist) has a lead over Le Pen (the nationalist), leaving the preopening S&P 500 futures up some 26 points at 5:00 a.m. as we watch the sun rise in Orlando at the RJFS National Conference. As we said last week, “Ready your buy lists!”

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

The opinions offered by Mr. Saut should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your Raymond James Financial Advisor.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.

Important Investor Disclosures

Raymond James & Associates (RJA) is a FINRA member firm and is responsible for the preparation and distribution of research created in the United States. Raymond James & Associates is located at The Raymond James Financial Center, 880 Carillon Parkway, St. Petersburg, FL 33716, (727) 567-1000. Non-U.S. affiliates, which are not FINRA member firms, include the following entities that are responsible for the creation and distribution of research in their respective areas: in Canada, Raymond James Ltd. (RJL), Suite 2100, 925 West Georgia Street, Vancouver, BC V6C 3L2, (604) 659-8200; in Europe, Raymond James Euro Equities SAS (also trading as Raymond James International), 40, rue La Boetie, 75008, Paris, France, +33 1 45 64 0500, and Raymond James Financial International Ltd., Broadwalk House, 5 Appold Street, London, England EC2A 2AG, +44 203 798 5600. This document is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The securities discussed in this document may not be eligible for sale in some jurisdictions. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Investors should consider this report as only a single factor in making their investment decision. For clients in the United States: Any foreign securities discussed in this report are generally not eligible for sale in the U.S. unless they are listed on a U.S. exchange. This report is being provided to you for informational purposes only and does not represent a solicitation for the purchase or sale of a security in any state where such a solicitation would be illegal. Investing in securities of issuers organized outside of the U.S., including ADRs, may entail certain risks. The securities of non-U.S. issuers may not be registered with, nor be subject to the reporting requirements of, the U.S. Securities and Exchange Commission. There may be limited information available on such securities. Investors who have received this report may be prohibited in certain states or other jurisdictions from purchasing the securities mentioned in this report. Please ask your Financial Advisor for additional details and to determine if a particular security is eligible for purchase in your state. The information provided is as of the date above and subject to change, and it should not be deemed a recommendation to buy or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. Persons within the Raymond James family of companies may have information that is not available to the contributors of the information contained in this publication. Raymond James, including affiliates and employees, may execute transactions in the securities listed in this publication that may not be consistent with the ratings appearing in this publication. Raymond James (“RJ”) research reports are disseminated and available to RJ’s retail and institutional clients simultaneously via electronic publication to RJ’s internal proprietary websites (RJ Investor Access & RJ Capital Markets). Not all research reports are directly distributed to clients or third-party aggregators. Certain research reports may only be disseminated on RJ’s internal proprietary websites; however such research reports will not contain estimates or changes to earnings forecasts, target price, valuation, or investment or suitability rating. Individual Research Analysts may also opt to circulate published research to one or more clients electronically. This electronic communication distribution is discretionary and is done only after the research has been publically disseminated via RJ’s internal proprietary websites. The level and types of communications provided by Research Analysts to clients may vary depending on various factors including, but not limited to, the client’s individual preference as to the frequency and manner of receiving communications from Research Analysts. For research reports, models, or other data available on a particular security, please contact your RJ Sales Representative or visit RJ Investor Access or RJ Capital Markets. Additional information is available on request. Simple Moving Average (SMA) – A simple, or arithmetic, moving average is calculated by adding the closing price of the security for a number of time periods and then dividing this total by the number of time periods. Exponential Moving Average (EMA) – A type of moving average that is similar to a simple moving average, except that more weight is given to the latest data. Relative Strength Index (RSI) – The Relative Strength Index is a technical momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of an asset. International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small-cap stocks generally involve greater risks. Dividends are not guaranteed and will fluctuate. Past performance may not be indicative of future results. Investors should consider the investment objectives, risks, and charges and expenses of mutual funds and exchange-traded funds carefully before investing. The prospectus contains this and other information about mutual funds and exchange –traded funds. The prospectus is available from your financial advisor and should be read carefully before investing. Raymond James Investment Strategy © 2017 Raymond James & Associates, Inc., member New York Stock Exchange/SIPC. All rights reserved. International Headquarters: The Raymond James Financial Center | 880 Carillon Parkway | St. Petersburg, Florida 33716 | 800-248-8863 5 For clients in the United Kingdom: For clients of Raymond James Financial International Limited (RJFI): This document and any investment to which this document relates is intended for the sole use of the persons to whom it is addressed, being persons who are Eligible Counterparties or Professional Clients as described in the FCA rules or persons described in Articles 19(5) (Investment professionals) or 49(2) (High net worth companies, unincorporated associations etc) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) or any other person to whom this promotion may lawfully be directed. It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons and may not be relied upon by such persons and is therefore not intended for private individuals or those who would be classified as Retail Clients. For clients of Raymond James Investment Services, Ltd.: This report is for the use of professional investment advisers and managers and is not intended for use by clients. For purposes of the Financial Conduct Authority requirements, this research report is classified as independent with respect to conflict of interest management. RJFI, and Raymond James Investment Services, Ltd. are authorised and regulated by the Financial Conduct Authority in the United Kingdom. For clients in France: This document and any investment to which this document relates is intended for the sole use of the persons to whom it is addressed, being persons who are Eligible Counterparties or Professional Clients as described in “Code Monétaire et Financier” and Règlement Général de l’Autorité des Marchés Financiers. It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons and may not be relied upon by such persons and is therefore not intended for private individuals or those who would be classified as Retail Clients. For clients of Raymond James Euro Equities: Raymond James Euro Equities is authorised and regulated by the Autorité de Contrôle Prudentiel et de Résolution and the Autorité des Marchés Financiers. For institutional clients in the European Economic Area (EEA) outside of the United Kingdom: This document (and any attachments or exhibits hereto) is intended only for EEA institutional clients or others to whom it may lawfully be submitted. For Canadian clients: This report is not prepared subject to Canadian disclosure requirements, unless a Canadian analyst has contributed to the content of the report. In the case where there is Canadian analyst contribution, the report meets all applicable IIROC disclosure requirements. Proprietary Rights Notice: By accepting a copy of this report, you acknowledge and agree as follows: This report is provided to clients of Raymond James only for your personal, noncommercial use. Except as expressly authorized by Raymond James, you may not copy, reproduce, transmit, sell, display, distribute, publish, broadcast, circulate, modify, disseminate or commercially exploit the information contained in this report, in printed, electronic or any other form, in any manner, without the prior express written consent of Raymond James. You also agree not to use the information provided in this report for any unlawful purpose. This is RJA client releasable resear ch This report and its contents are the property of Raymond James and are protected by applicable copyright, trade secret or other intellectual property laws (of the United States and other countries). United States law, 17 U.S.C. Sec.501 et seq, provides for civil and criminal penalties for copyright infringement. No copyright claimed in incorporated U.S. government works.